Is it beneficial to invest in small and mid-cap stocks?

Stocks of the companies that have small

proportion of market share in their industries and with good managements bear

foremost potential of exponential growth. Such companies are usually have small cap and medium cap stocks and therefore

Multibagger stocks are generally from small or medium cap stocks.

Now what is this Multibagger returns or

Multibagger Stocks???

Multibagger stocks are stocks that are

expected to give multiple times returns in specific time period. Suppose stock

delivered you 1 time (100%) return in 3 years than the stocks are known as

single bagger stocks. If stocks give 5 times returns then they are 5 bagger

stocks. Same way if you get multiple times returns it means those are

multibagger stocks. For multibagger stocks you would need many bags to carry

its returns. Small cap and mid cap stocks has high growth capacity and deliver

high ROI as gives high capital appreciation.

Small-caps stocks generally refers to, shares of

companies where market capitalization, or the value of all shares owned by all

shareholders in the company amounts to less than 500 million. This definition

is not universal however, and in some cases companies with market

capitalization of as high as 2 billion may be referred to as small cap stocks.

Although small cap stocks can belong to any

industry, many small-cap companies are in new or high growth industries. These

companies may lack stable revenue and earnings but generally promise superior

growth prospects, and investors are drawn to invest in them in the search for

potentially higher returns.

In general, small cap stocks

are riskier as an asset class, since many small companies fail to continue as

viable businesses. However, if a small company does succeed, it generally

results in very handsome rewards for the investors in the stock of that company.

Investing in small cap stocks therefore is not for everyone. Such investments

are more suitable for growth investors, who are willing to take more risk and

have longer investment horizon, therefore Multibagger stocks are also known as growth

stocks.

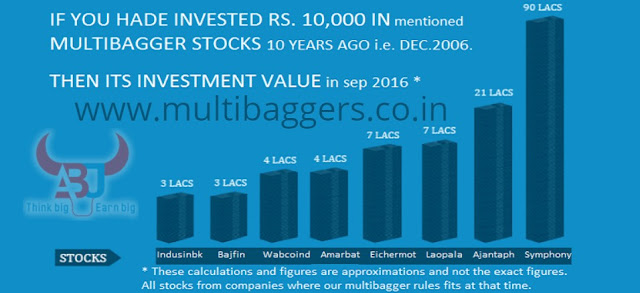

It is a fact that many

successful big companies started very small and their stocks were small cap

stocks during the early stages of their evolution. The stock market is abound

with examples of companies such as Nilkamal, Eicher Motors, Page Industries, to

name a few, which were small businesses and had small market capitalization in

the beginning. Those individuals who invested in such companies at an early

stage and remained invested reaped huge returns over time. Long term investment in stocks can convert your merry thousand of rupees into lacs

in time span of few years. Below are few

examples of it…

Most small cap stocks belong

to companies that are still at an early stage of development. These companies

are normally more focused and devote their attention to a particular business

area. It is easier to analyze such companies and properly evaluate their

business prospects in the near future as opposed to bigger companies that can

have complex operations.

Comments

Post a Comment